Weak restrictions on flavored e-cigarettes lead to explosive menthol sales

Sales of menthol e-cigarettes increased by almost $60 million and its market share more than doubled after it was exempted from federal restrictions that removed only some flavored e-cigarettes from the market, according to a Truth Initiative® analysis.

The study, published in Tobacco Control, highlights the failings of partial flavor restrictions to protect young people from the risks of e-cigarettes and underscores that consumers are willing to switch flavors based on product availability. It also reinforces the long-standing need to remove all flavors, including menthol, from the market. Flavored e-cigarettes, including menthol, play a significant role in youth e-cigarette initiation. More than 80% of youth who have used tobacco report that they began with a flavored product and 97% of youth who vape use flavors.

In response to public outcry over youth vaping in 2019, JUUL Labs removed its mint-flavored e-cigarettes from the market. JUUL’s voluntary move was followed closely by the January 2020 Food and Drug Administration guidance that prohibited flavored cartridge-based sales but allowed the sale of tobacco- and menthol-flavored cartridges, open-systems, and disposable e-cigarettes.

Menthol is the new mint

What's the difference between menthol and ming

The data show that menthol has effectively replaced mint, which was previously one of young people’s favorite flavors.

After JUUL voluntarily removed mint-flavored e-cigarettes, the market share of menthol-flavored products increased by almost 60% and sales increased by $30.4M during the four-week period following the removal. At the same time the market share of mint-flavored products decreased by 39% and total e-cigarette sales declined by $13.5 million.

Following the FDA’s guidance around the removal of non-menthol-flavored cartridge-based e-cigarettes in January 2020, menthol e-cigarette sales increased by $59.5 million and its market share shot up by 105% (from 24% to 49%) during the roughly eight-week period following the announcement. Menthol sales may have been driven by losses in mint sales, since the market share of mint e-cigarettes decreased by 89% (from 26% to 4%) and sales declined by $79.5 million during the same time frame. By March 2020, menthol-flavored e-cigarette sales rose to an all-time high of 58% market share.

Menthol was previously not a top e-cigarette flavor. It accounted for only about one-tenth of e-cigarette sales in August 2019. Menthol cigarettes, however, have long had a disproportionate impact on young people and evidence shows that they are easier to smoke and harder to quit.

“Despite the decades of evidence related to the role of menthol in facilitating the uptake of tobacco products, this flavor remains on the market for both cigarettes and e-cigarettes, and this study illustrates a willingness among e-cigarettes consumers to shift to using this flavor,” the study authors write.

To evaluate the impact of these policy changes on e-cigarette sales, researchers examined retail scanner data from September 2013 to March 2020 from convenience stores, food/drug/mass merchandisers, discount stores, and military commissaries sales.

Shifts in sales underscore need for stronger flavor policies

mint vs menthol vape

The drastic, immediate rise in menthol e-cigarette sales following policies curbing the sale of other flavored products reveals that industry self-regulation and incomplete flavor bans don’t work. Comprehensive regulation of e-cigarettes is needed to protect young people.

“The lack of comprehensive e-cigarette restrictions continues to put the health of America’s young people at risk. In light of high youth vaping rates and mounting concerns that smoking and vaping may increase risk of severe complications from COVID-19, comprehensive FDA regulation of e-cigarettes remains as critical as ever,” the authors write.

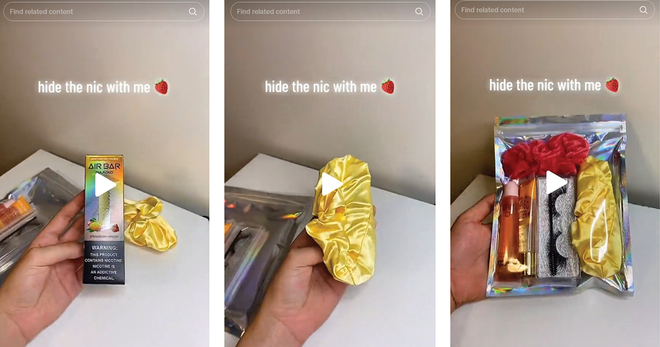

A separate Truth Initiative analysis shows that another product type exempted from federal restrictions has also been thriving in the absence of comprehensive regulation. Flavored disposable e-cigarettes such as Puff Bar have soared in popularity. Together with menthol e-cigarettes, they have rapidly gained nearly three-quarters of the e-cigarette market.

September 9 marked the deadline for e-cigarette makers to submit applications to the FDA to keep their products on the market. As the agency reviews these products, it must act quickly to remove all flavored e-cigarettes that put a generation at risk of nicotine addiction. Some states are acting in the meantime: California recently passed a statewide ban on all flavored tobacco products – including menthol – making it only the second state after Massachusetts to do so.